Analyst: India to Lead Asia-Pacific Non-Vascular Stents Market Growth by 2021

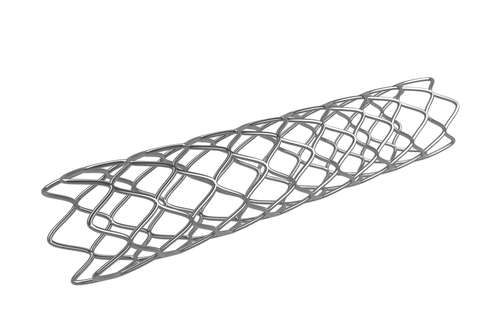

The Asia-Pacific (APAC) non-vascular stents market, consisting of urinary tract, pancreatic and biliary, enteral, and airway stents, will expand in value from $148.1 million in 2013 to $223.8 million by 2021, at a Compound Annual Growth Rate (CAGR) of 5.3 percent, said research and consulting firm GlobalData.

The Asia-Pacific (APAC) non-vascular stents market, consisting of urinary tract, pancreatic and biliary, enteral, and airway stents, will expand in value from $148.1 million in 2013 to $223.8 million by 2021, at a Compound Annual Growth Rate (CAGR) of 5.3 percent, said research and consulting firm GlobalData.

The company’s latest report states that of the key APAC countries of India, Japan and China, India will lead the APAC region, with its own market value increasing from $31.5 million in 2013 to $50.4 million by 2021, representing a higher CAGR of 6 percent.

Japan and China will follow India, with their markets increasing at respective CAGRs of 5.2 percent and 5 percent over the same period.

Priya Radhakrishnan, GlobalData’s Director of Medical Devices, said: “India is set to overtake China in becoming the world’s most populous country around 2020, leading to a significant patient base and rapidly-expanding medical device market.

“The flexibility of manufacturers with respect to the use of stents, such as employing a pay-as-you-go model, will be hugely important in driving India’s non-vascular stent market in the future.”

Radhakrishnan adds that of the four non-vascular stent segments, India’s urinary tract stents arena will continue to hold the largest market share of 55.3 percent in 2021, up from 54.1 percent in 2013. While this is mainly due to a large population base commonly affected by urolithiasis, the country’s low cancer incidence also means the other segments will constitute fewer shares in the market.

Despite the projected increase of India’s overall non-vascular stents market to 2021, the director said that numerous barriers will hinder further growth.

Radhakrishnan continues: “Rural areas and smaller cities are still underserved with respect to stenting procedures, and are awaiting the most current technologies’ arrival.

“Furthermore, India’s market remains challenging for multinational corporations to penetrate, with unstable distribution networks and the prominence of low-cost manufacturers. In a country with high procedure volumes, local manufacturers can produce products at a third of multinationals’ costs, allowing them to compete directly with foreign companies.”